Support our educational content for free when you purchase through links on our site. Learn more

Master the Car Lease Buyout Process: 10 Expert Tips You Need in 2025 🚗

Have you ever found yourself staring at your leased car, wondering if you should just keep it instead of returning it? You’re not alone. Millions of drivers face this dilemma every year. The car lease buyout process can seem like a maze of confusing terms, hidden fees, and paperwork—but it doesn’t have to be that way. In fact, with the right knowledge and insider tips, you can turn your lease into a smart purchase that saves you money and stress.

Did you know that nearly 30% of leaseholders consider buying out their lease early, yet many miss out on potential savings because they don’t understand the process fully? Stick around, because we’re breaking down everything from how to evaluate your buyout price to negotiation hacks that could shave hundreds off your final cost. Plus, we’ll reveal some alternatives if buying out isn’t the best fit for you. Ready to take control of your lease and drive off with confidence? Let’s dive in.

Key Takeaways

- Understand your lease agreement’s buyout terms to avoid surprises and fees.

- Compare the buyout price to your car’s current market value using trusted tools like Kelley Blue Book or Edmunds.

- Evaluate your vehicle’s condition and mileage to decide if buying out is financially smart.

- Explore financing options carefully to secure the best loan terms for your buyout.

- Negotiate with your leasing company—there’s often room to lower fees or adjust terms.

- Consider alternatives like lease extensions or trading in if a buyout isn’t ideal.

With these insights, you’ll be equipped to make the best decision for your wallet and your wheels. Ready to become a lease buyout pro? Keep reading!

Table of Contents

- ⚡️ Quick Tips and Facts About Car Lease Buyouts

- 🔍 Understanding the Car Lease Buyout: What It Really Means

- 🤔 Why Consider Buying Out Your Car Lease? Top Motivations Explained

- 📊 Key Factors to Evaluate Before Committing to a Lease Buyout

- 🛠️ The Step-by-Step Car Lease Buyout Process Demystified

- 💰 7 Advantages of Buying Out Your Car Lease You Should Know

- ⚠️ 6 Disadvantages and Pitfalls of Lease Buyouts to Watch Out For

- 🗣️ Expert Tips for Negotiating the Best Deal on Your Lease Buyout

- 🔄 Alternatives to Lease Buyouts: What Are Your Other Options?

- 📈 How Market Trends Affect Your Lease Buyout Decision

- 🚗 What Happens After You Buy Out Your Lease? Ownership and Beyond

- 💳 Island Credit Mastercard® – The One Card That Has It All for Car Buyers

- 📝 Conclusion: Is a Car Lease Buyout Right for You?

- 🔗 Recommended Links for Car Lease Buyout Resources

- ❓ Frequently Asked Questions About Car Lease Buyouts

- 📚 Reference Links and Further Reading

Quick Tips and Facts About Car Lease Buyouts

To get started with understanding car lease buyouts, it’s essential to visit our page on Car Leases for a comprehensive overview. A car lease buyout is the process of purchasing a leased vehicle before or at the end of the lease contract. Here are some key points to consider:

- Lease buyout definition: It’s an option that allows you to purchase your leased vehicle, either at the end of the lease term or, in some cases, during the term.

- Buyout price: The price is typically set in your lease agreement and may not always reflect the vehicle’s current market value.

- Evaluation process: Review your lease terms, compare the buyout cost to current market pricing, and factor in potential fees.

- Key considerations: Consider the value vs. cost, market alternatives, and convenience of buying out your lease.

For more information on car lease basics, visit our category page on Car Lease Basics.

Understanding the Car Lease Buyout: What It Really Means

A car lease buyout is a significant decision that requires careful consideration. According to Edmunds, a lease buyout can be a good deal if the preset price (based on residual value) is lower than the car’s market value. To determine the market value of your vehicle, you can use resources like KBB.com or Edmunds.com.

Why Consider Buying Out Your Car Lease? Top Motivations Explained

There are several reasons why you might consider buying out your car lease. Some of the top motivations include:

- Maintaining ownership of the car

- Avoiding potential end-of-lease fees (e.g., for exceeding mileage limits or vehicle damage)

- Keeping a car you like and are familiar with

- Potentially paying less than market value if the buyout amount is lower

As noted in the first YouTube video, buying out your car lease can be a good option, especially since it’s a “good used car to buy” that you’re already familiar with.

Key Factors to Evaluate Before Committing to a Lease Buyout

Before deciding to buy out your lease, there are several key factors to evaluate:

- Vehicle condition: If the condition is poor, you might face fees upon return, making a buyout potentially more attractive.

- Market value: If the car’s market value is higher than expected, a buyout could be financially beneficial.

- Lease terms: Review any fees or penalties associated with the lease.

- Costs: Factor in loan interest and future maintenance/repair responsibilities.

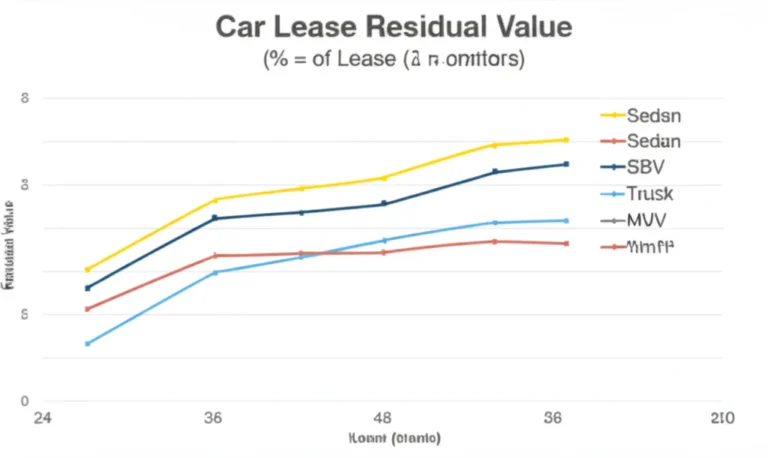

- Depreciation: Be aware that the car will continue to depreciate after purchase.

For more information on the latest car lease deals, visit our category page on Latest Car Lease Deals.

The Step-by-Step Car Lease Buyout Process Demystified

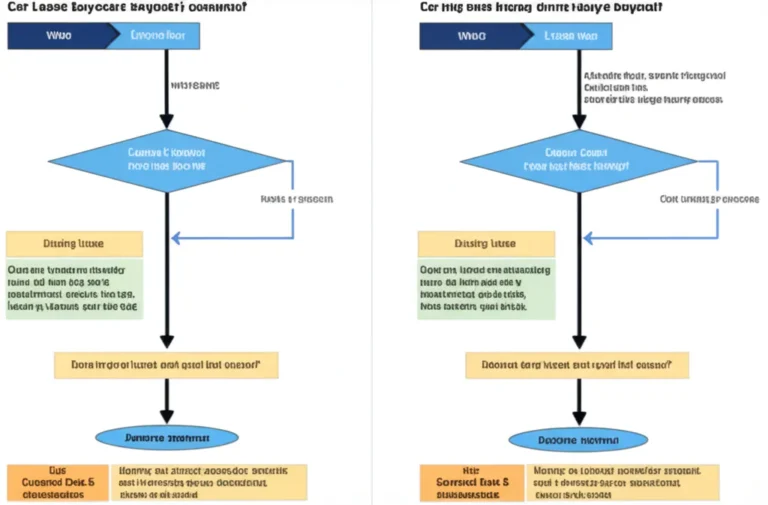

The lease buyout process typically involves the following steps:

- Check your lease agreement: Find the residual value (buyout price) and contact your leasing company to confirm the exact amount.

- Research your car’s market value: Use resources like KBB.com or Edmunds.com.

- Compare buyout price to market value: If market value > buyout price, it’s a good deal.

- Secure financing (if needed): Consider various lenders (credit unions, banks) and compare interest rates, terms, and conditions.

- Notify the leasing company of your intent: Inform the leasing company of your decision to proceed.

- Complete the lease buyout process: Sign paperwork with the leasing company, and the lender will help facilitate the title transfer.

7 Advantages of Buying Out Your Car Lease You Should Know

Here are 7 advantages of buying out your car lease:

- Potentially pay less than market value: If the buyout amount is lower than the car’s market value.

- Saves time on shopping for a new car: You already have the car, so you don’t need to spend time searching for a new one.

- May not be charged for excess wear and tear: Depending on the lease terms, you may not be responsible for excess wear and tear.

- May not be charged for exceeding mileage limits: Similarly, you may not be responsible for exceeding mileage limits.

- Allows you to keep a car you like: You can keep the car you’re familiar with and enjoy.

- No need to worry about lease-end fees: You won’t have to worry about potential lease-end fees.

- You can customize the car to your liking: Once you own the car, you can make any modifications or customizations you want.

6 Disadvantages and Pitfalls of Lease Buyouts to Watch Out For

Here are 6 disadvantages and pitfalls of lease buyouts to watch out for:

- May overpay if the buyout amount is higher than market value: If the buyout amount is higher than the car’s market value, you may end up overpaying.

- Financing a lease buyout might have higher interest rates: Interest rates for lease buyouts might be higher than traditional auto loans.

- Excessive wear, tear, and mileage can reduce the vehicle’s value: If the car has excessive wear, tear, or mileage, its value may be reduced.

- You might end up paying more than if you had bought the car initially: Depending on the lease terms and buyout price, you might end up paying more than if you had bought the car initially.

- You’ll be responsible for maintenance and repair costs: Once you own the car, you’ll be responsible for maintenance and repair costs.

- You may not be able to sell the car easily: Depending on the car’s condition and market demand, you may not be able to sell the car easily.

Expert Tips for Negotiating the Best Deal on Your Lease Buyout

Here are some expert tips for negotiating the best deal on your lease buyout:

- Timing: Negotiate closer to the lease end for more leverage. Look for promotions.

- Market research: Compare your vehicle to similar ones on the market, considering its condition.

- Mileage: Use mileage (especially excess mileage) as a point for negotiation to offset costs.

- Fees and terms: Negotiate all components, including fees, and request waivers or flexible terms.

Alternatives to Lease Buyouts: What Are Your Other Options?

If you’re not sure about buying out your lease, there are other options to consider:

- Returning the car: You can return the car to the leasing company and walk away.

- Extending the lease: You may be able to extend the lease for a shorter period, such as 6-12 months.

- Trading in the car: You can trade in the car for a new one, either with the same leasing company or a different one.

For more information on electric vehicle leases, visit our category page on Electric Vehicle Leases.

How Market Trends Affect Your Lease Buyout Decision

Market trends can significantly impact your lease buyout decision. For example:

- Low market value: If the car’s market value is low, it may not be a good time to buy out the lease.

- High demand: If there’s high demand for the car, you may be able to sell it for a good price if you decide to buy out the lease.

- Economic conditions: Economic conditions, such as interest rates and inflation, can affect the cost of financing a lease buyout.

What Happens After You Buy Out Your Lease? Ownership and Beyond

After you buy out your lease, you’ll own the car outright. Here are some things to consider:

- Registration and title: You’ll need to register the car in your name and obtain a new title.

- Insurance: You’ll need to insure the car, and your insurance rates may change.

- Maintenance and repair: You’ll be responsible for maintenance and repair costs.

- Customization: You can customize the car to your liking, but be aware that some modifications may void the warranty.

Island Credit Mastercard® – The One Card That Has It All for Car Buyers

If you’re considering buying out your lease, you may want to consider using a credit card like the Island Credit Mastercard®. This card offers a range of benefits, including:

- Rewards: Earn rewards on your purchases, including gas, groceries, and more.

- Low interest rates: Enjoy low interest rates on your purchases and balance transfers.

- No annual fee: There’s no annual fee, so you can save money on your credit card expenses.

- Travel benefits: Get travel insurance, rental car insurance, and other travel-related benefits.

To apply for the Island Credit Mastercard®, visit their official website or check out Auto Financing Options on our website for more information.

Conclusion: Is a Car Lease Buyout the Right Move for You?

After diving deep into the ins and outs of the car lease buyout process, it’s clear that this option can be a savvy move — but only if the stars align in your favor. If you love your leased vehicle, have kept it in great shape, and the buyout price is below or close to the current market value, buying out your lease can save you money, hassle, and the headache of hunting for a new car. Plus, you get to keep a car you already know and love — no surprises there!

However, beware of potential pitfalls: overpaying if the buyout price exceeds market value, higher financing rates compared to new car loans, and the responsibility of maintenance and repairs once ownership transfers. Remember, the buyout price is often fixed in your lease contract, but savvy negotiation and market research can sometimes tip the scales in your favor.

If you’re on the fence, consider your long-term plans. Are you ready to commit to owning this car for years to come? Or would a fresh lease or purchase better suit your lifestyle? Our expert advice: crunch the numbers, inspect the vehicle thoroughly, and shop around for financing options before sealing the deal.

And hey, if you’re looking for a credit card that complements your car-buying journey, the Island Credit Mastercard® offers rewards and benefits that can help ease the financial ride.

So, what’s your next move? Will you keep the car you’ve grown attached to, or is it time to explore new wheels? Either way, you’re now equipped with the knowledge to make a confident, informed decision.

Recommended Links for Car Lease Buyout Resources

-

👉 Shop Toyota Lease Buyouts on:

TrueCar | Edmunds | Toyota Official Website -

👉 Shop Honda Lease Buyouts on:

AutoTrader | Edmunds | Honda Official Website -

👉 Shop Ford Lease Buyouts on:

TrueCar | AutoTrader | Ford Official Website -

Island Credit Mastercard® Application and Info:

Island Federal Credit Union

Frequently Asked Questions About Car Lease Buyouts

What are the steps involved in the car lease buyout process?

The process typically includes:

- Reviewing your lease agreement to identify the buyout price and terms.

- Researching your vehicle’s current market value using tools like KBB.com or Edmunds.com.

- Comparing the buyout price to market value to determine if it’s financially sensible.

- Securing financing, if necessary, by shopping around for the best loan terms.

- Notifying the leasing company of your intent to buy out the lease.

- Completing paperwork and title transfer with the leasing company and lender.

This step-by-step approach ensures you’re making an informed decision and handling all legal and financial aspects properly.

How do I know if a car lease buyout is a good deal?

A good deal usually means the buyout price is equal to or less than the car’s current market value. Use trusted valuation sites like Edmunds or Kelley Blue Book to check your car’s worth. Also, consider your personal usage plans — if you intend to keep the car for several years, a buyout might be more cost-effective than leasing or buying new.

Can I negotiate the price during a car lease buyout?

While the buyout price is often set in your lease contract, negotiation is sometimes possible, especially if the vehicle’s market value is lower than the residual value. Use factors like excess mileage, wear and tear, or upcoming maintenance needs as leverage. Timing your negotiation near the lease end and being polite but assertive can improve your chances.

What fees should I expect when buying out a car lease?

Expect to pay:

- The residual (buyout) price specified in your lease.

- Possible purchase option fees or administrative fees charged by the leasing company.

- Sales tax on the purchase price, which varies by state.

- Financing fees if you take out a loan.

- Title and registration fees for transferring ownership.

Always ask your leasing company for a detailed breakdown to avoid surprises.

How does financing work for a car lease buyout?

You can finance a lease buyout through banks, credit unions, or sometimes the leasing company itself. Interest rates may be slightly higher than new car loans since the vehicle is used. Loan terms typically range from 36 to 72 months. It’s wise to shop around for the best rates and terms to fit your budget. Check your credit score beforehand, as better scores usually secure better financing.

When is the best time to buy out a car lease?

The best time is usually near the end of your lease term, when you have the most information about the vehicle’s condition and market value. However, some opt for an early buyout if they anticipate excess mileage or damage fees. Keep an eye on market trends and promotions from your leasing company, as these can influence timing.

What documents do I need to complete a car lease buyout?

You’ll typically need:

- Your lease agreement and any buyout paperwork.

- Proof of financing if applicable.

- Identification (driver’s license or state ID).

- Payment for the buyout price, taxes, and fees.

- Title transfer documents, which the leasing company or lender usually provides.

Confirm with your leasing company for any additional requirements.

Reference Links and Further Reading

- Lease to Own Car: How to Buy Out Your Lease | Chase

- How Does a Lease Buyout Work? | Island Federal Credit Union

- Auto Lease Buyout Guide | Navy Federal Credit Union

- Edmunds Car Lease Buyout Overview

- Kelley Blue Book

- Consumer Reports: Leasing vs Buying

These sources provide authoritative insights and can help you verify the facts and deepen your understanding of the lease buyout process.